When forecasting machinery production, monthly production indicators provide one factor considered in our methodology. However, different regions have a variety of indicators which help us to refine our machinery forecast. A key leading indicator available in Germany is order range (a forward-looking indicator showing backlog level).

In 2025, some machinery sectors have hit new peaks in order range while others have fallen below any average level seen over the past six years. We can cross-reference this with manufacturing industry output (MIO) tracker data to better understand how these backlogs align with actual production.

Overall, we expect German machinery production to shrink by 5.9% in 2025 due to competition from China and Eastern European regions, export problems due to US tariffs; and an overall slowdown in domestic manufacturing.

What is the current machinery outlook in Germany?

By comparing the MIO tracker forecasts with order range data, it is possible to build a more complete picture of the overall outlook for Germany’s machinery sector.

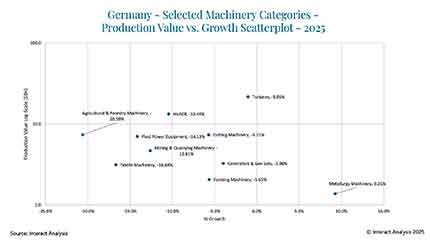

The graph below shows forecast MIO output and growth for selected MIO machinery categories in Germany during 2025.

Germany’s machinery sector is facing a tough 2025, with large contractions forecast for several major market segments

2025 looks set to be a difficult year for most German machinery sectors, with segments such as mining and quarrying machinery, agricultural and forestry machinery, and textile machinery; all expected to shrink by more than 10%. Metallurgy machinery is one of the few exceptions to this trend, with projected growth of just under 10%.

How is the order range for these sectors performing?

2025 order range data reveal a clear divergence across Germany’s machinery sectors. Categories such as mining and quarrying machinery, textile machinery, and fluid power equipment have seen a sharp fall in backlog time, with 2025 down more than 30% from peak levels. HVACR and agricultural machinery also show marked declines, suggesting a significant easing of order books. In contrast, generators and gen sets is at a record-high order range of 11.8 months, while metallurgy machinery continues to operate near its all-time peak, with a 2025 average of 61.2 months, just below the high of 2024.

Comparing order range to outlookEvidently, there is a strong correlation between these two factors, with textile machinery perhaps the most striking example. The sector’s order range has nearly halved since 2022, and it is expected to contract by 16.7% in 2025. Similarly, agricultural machinery has lost almost a fifth of its order backlog and faces a 20% decline in output, pointing to a dramatic loss of momentum. Whether this reflects cooling investment, oversupply, or weakening demand is difficult to determine, but the scale of the slowdown in these sectors is stark.

Generators and gen sets are currently at a six-year peak in order range, yet production is still expected to decline, corroborated by weak monthly indicators in Q1. This highlights a key divergence between pipeline strength and actual output.

Two major forces are currently working in favour of specific machinery sectors. First, the ongoing energy transition driven by a shift toward more sustainable fuels and a move away from politically sensitive energy sources is expected to boost demand for turbines and generator sets. Second, increased EU spending on defence is likely to spur procurement of military equipment, which in turn supports demand for metalworking machinery. Broader national security concerns, particularly around the resilience of critical infrastructure such as hospitals and data centres, also reinforce the need for power generation machinery.

While sectors such as generators, turbines, and metallurgy machinery may not face immediate risks given these positive tailwinds from the energy transition and defence procurement, it’s clear that high order backlog does not always translate into high production volumes right now.

Whether these shifts are structural or short term remains uncertain. In some cases, falling order ranges may reflect a post-pandemic correction or investment pause. In others, particularly where both backlogs and output are falling sharply, they could signal deeper, more enduring demand realignments. Continued monitoring will be essential to separate temporary softness from long-term change.

ConclusionOrder backlogs show where the pressure is building up and our MIO production figures reveal where the cracks are manifesting. In Germany’s machinery sector, that tension is clear. With metallurgy machinery surging and textiles machinery stumbling, there isn’t one narrative in German machinery, there are several.

Component suppliers and machine builders should be watching both datasets. How long will the order book lasts? And how well is production holding up? No single indicator tells the whole story. Some segments are riding long-term demand; others are slipping fast. As 2025 unfolds, tracking both order range and manufacturing output will be essential to distinguish short-term slowdowns from deeper structural shifts. That’s exactly why this dual-lens analysis is built into our MIO forecasting approach.

(The author is a senior data analyst)