|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Packaged wheat flour market growth 19% CAGR; may reach Rs 7500 cr: Ikon

|

|

Tuesday, 30 June, 2015, 08 : 00 AM [IST]

|

|

|

|

fiogf49gjkf0d Though the wheat flour market is largely dominated by local chakki mills in India, the branded packaged wheat flour segment is emerging rapidly in the country by offering better quality, nutrition and convenience.

The Indian packaged wheat flour market comprises few national players and large number of regional and private label brands operating at pan-India or restricted geographic market based on their size & capacity.

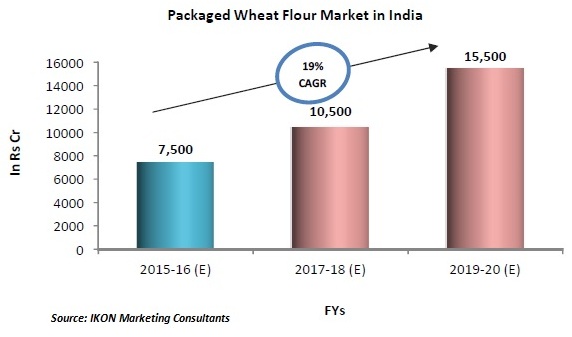

According to estimates by leading marketing consulting firm Ikon Marketing Consultants, the packaged wheat flour market in India is growing at CAGR of almost 19% since past three years. If the growth trajectory remains the same, the market may likely to touch the new height of more than Rs 7,500 crore in current fiscal (2015-16) itself.

In terms of volume, the packaged wheat flour market in India was more than 22 lakh tonne during last fiscal 2014-15, growing at a healthy double digit CAGR of 15% over the past three years.

The urban market dominates packaged wheat flour market in India. As per Ikon’sestimates, the urban market occupies more than 90% of the total market where as due to penetration of packaged food in rural India, rural consumers’ willingness towards the packaged wheat flour found somewhat increased.

The annual per capita consumption of packaged wheat flour in India remained nearly 1.85 kg, during fiscal 2014-15. However, the urban market leads in per capita consumption of packaged wheat flour with almost 5.50 kg, making packaged wheat flour an urban phenomenon.

The north-central region is the major consumer of packaged wheat flour in India. According to the company’s estimation for fiscal 2014-15, in terms of value, the north-central region comprises almost 44% of the overall India’s packaged wheat flour market.

The Future

The growing numbers of working women and their inclination towards convenient food products; will enhance the future demands of packaged wheat flour in India. According to the company’s estimates, if the growth trajectory remains the same, the market of packaged wheat flour may likely to be more than double the current size by the end of current decade.

The marketer needs to come up with new and innovative product packaging and product proposition for differentiating themselves and for sustainable long-term growth. It is also expected that the consumers would eventually give more importance to origin of ingredients and related convenience factors in case of packaged wheat flour, according to Taruna Sondarva, sr consultant, Ikon.

The Current Market Trends

However, with the entry of large number of market players having better quality, fresh and convenience-packaged flour; the wheat flour consumption trends have been shifting towards the branded packaged atta.

The rigorous advertising in print and visual media campaigning on quality, hygiene, health, convenience factors by the players are helping to heighten the sales of packaged wheat flour in the country.

The Competition

The Indian packaged wheat flour market consists of plenty of brands each one is trying to distinguish themselves with origin of wheat, manufacturing process, quality, taste, textures and price to attract customers. Besides leading brands, there are more than 500 regional brands in India. Each flourmill has its own brand, sometimes even more than 2 brands of packaged wheat flour.

ITC’s ‘Aashirvaad’ is the clear market leader among the national players in branded packaged wheat flour market in India with occupying more than 35% market share where as several regional brands (produced by flourmills serving region-specific market) together occupy major 40% share of market.

Shakti Bhog with wider penetration holds almost 12% market share where as other national players such as Pillsbury, Nature Fresh and Annapurna occupy below 10% market share.

Consumer Insights

Urban consumers belonging to SEC A & Class dominate the consumption of packaged wheat flour in India; among which working couples, young single living, nuclear families, and health-conscious consume highest packaged wheat flour in India. The various underlying factors driving the consumers for purchase of packaged wheat flour are fulfilment of basic nutrition needs; convenience and saving of time; deficiency in storage of wheat in bulk; and perception of high quality of packaged wheat flour. More than 70%, particularly health and quality-conscious consumers, prefer to buy specific brands of packaged wheat flour showing brand loyalty.

The Major Challenge

Due to varied geographical taste preferences and beliefs, satisfying Indian consumer with standard offerings remains the biggest challenge for marketers and so is the case with packaged wheat flour.

|

|

|

|

|

|

|

|

|

|