|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Sweets like gulab jamun cheesecake redefining traditional tastes

|

|

Friday, 26 September, 2025, 16 : 00 PM [IST]

|

|

Venkatesh Ganapathy

|

The Indian sweets (mithai) industry is undergoing a remarkable transformation. The sector is rapidly evolving into a formalised, dynamic market driven by changing consumer preferences, innovation, and modernisation. With deep cultural roots and rising global appeal, the industry is poised for significant growth both domestically and internationally.

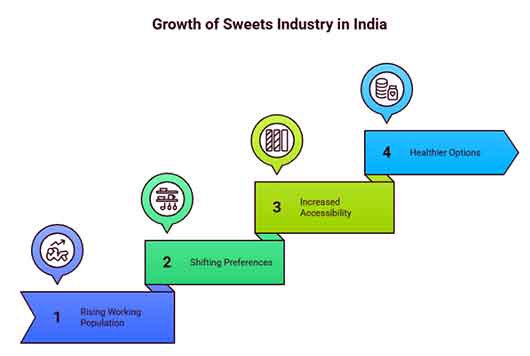

India’s sweets market was valued at approximately Rs 593 billion (around $7–8 billion) in 2022, and it reached Rs 7,268.0 crore in 2024. Despite 90% of the market still being unorganised, the organised segment is expanding rapidly, growing at a Compound Annual Growth Rate (CAGR) of 16.6%, compared to the overall market growth of 8–10% annually. The packaged sweets segment alone was valued at Rs 7,268 crore in 2024 and is projected to grow to Rs 27,648 crore by 2033. This growth is being driven by a robust CAGR of 16%. A separate report by IMARC Group provides a similarly optimistic forecast, estimating the market to reach Rs 15,057 crore by 2028, growing at a CAGR of 19.1% from 2023 to 2028.  Several factors are fuelling this expansion. Increased awareness about food safety, particularly, after the Covid-19 pandemic, has led consumers to prefer hygienically packaged sweets over loose, traditional options. Rapid urbanisation, a growing working population, and shrinking family sizes have also increased the demand for ready-to-eat and convenient sweet products. Moreover, the gifting culture in India, which heavily revolves around sweets during festivals and celebrations, has found a perfect match in attractively packaged and ready-made offerings that are available year-round.

Innovation is playing a central role in the growth of this market. Consumers are increasingly choosing healthier options such as sugar-free, low-calorie, and protein-enriched sweets made with natural ingredients like jaggery, stevia, and honey. There is a growing preference for sweets fortified with functional ingredients such as dietary fibre, nuts, millets, and plant proteins. At the same time, fusion and experimental flavours are becoming popular. For instance, sweets like gulab jamun cheesecake and mithai-inspired chocolates or waffles are redefining traditional tastes by blending them with Western dessert formats. Alongside these innovations in flavour and formulation, brands are elevating their product presentation through luxurious packaging and storytelling, which appeals particularly to younger, experience-driven consumers.

Modern distribution strategies are further accelerating growth. The expansion of e-commerce and the use of direct-to-consumer (D2C) platforms have allowed sweet brands to connect with a broader audience across both urban and semi-urban areas. Retail distribution has expanded significantly, with packaged sweets now readily available in supermarkets, convenience stores, milk outlets, and online platforms, ensuring greater accessibility and consistent quality.

North India continues to dominate the market with a 35% share, followed by East India at 28%, West India at 24%, and South India at 13%. However, all regions are witnessing growth, especially, in urban centres. On the global front, Indian sweets are increasingly finding their way to international shelves. While the Indian diaspora in countries like USA, UAE, UK, Australia, and Canada remain a core market, brands are now targeting a wider international audience. They are achieving this through premium positioning, using elegant and colourful packaging to portray mithai as a luxury product comparable to high-end chocolates.

To appeal to global consumers, brands are innovating with ingredients and formats. They are introducing fusion products using global flavours like dark chocolate, coffee, and exotic fruits. These are often presented in familiar formats such as bars or bite-sized confections that are easy to consume and share. There is also a notable shift toward health and wellness, with clean-label, gluten-free, and Ayurvedic-inspired sweets gaining popularity. Natural sweeteners like jaggery, coconut sugar, and date syrups are increasingly being used, along with high-fibre ingredients such as inulin, chicory root fibre, and soluble corn fibre. Protein-enriched sweets fortified with almond, coconut, chickpea, and soy proteins are also seeing rising demand. Some brands are even offering baked versions of traditional sweets or incorporating plant-based dairy alternatives to reduce fat content.

One of the key breakthroughs that has enabled the global reach of Indian sweets is the advancement in food packaging and logistics. Technologies such as vacuum sealing, biodegradable containers, and temperature-controlled transport systems have significantly extended the shelf life of sweets and maintained their hygiene, making them viable for international export. E-commerce has played a crucial role in global outreach. Many brands are leveraging their own websites, online marketplaces, and social media to reach international consumers directly.

Despite its promising future, the sweets industry in India faces several challenges. Maintaining food safety and quality at scale, especially, in the face of growing demand, remains a concern. There is also the challenge of adulteration, particularly in the unorganised sector. Rising input costs—especially for sugar, milk, and packaging materials—add pressure on margins. Short shelf life continues to be a logistical hurdle, requiring further innovation in supply chain and preservation technologies. Additionally, companies must stay compliant with evolving regulatory standards and compete in an increasingly fragmented market filled with both traditional halwais and modern FMCG brands.

Nevertheless, the outlook for the Indian sweets industry remains highly optimistic. The next 5–10 years are expected to see continued growth, with the overall market potentially doubling in value by 2030–2032. The organised sector is projected to quadruple in the same period. Opportunities abound in premiumisation, health and wellness products, expansion into new global markets, and digital distribution. The emergence of niche segments such as vegan, keto-friendly, and low-glycemic-index sweets also indicates a maturing market that is ready to cater to highly specific consumer needs.

Ingredient suppliers have a significant role to play in this transformation. Their expertise and innovation can support sweet manufacturers by offering solutions for sugar reduction, fibre fortification, shelf stability, and protein enrichment. As the demand for health-oriented and functional sweets grows, partnerships between ingredient companies and sweet brands will become increasingly vital to ensure product success. The Indian sweets industry stands at a pivotal crossroads. It is uniquely positioned to preserve its deep-rooted traditions while embracing global trends and innovations. With the right blend of authenticity, creativity, health-consciousness, and strategic branding, Indian mithai is set to thrive in both domestic and international markets in the years to come.

(The author is faculty member, Kirloskar Institute of Management Studies, Harihar)

|

|

|

|

|

|

|

|

|

|