|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Innovative Flavors & Healthy Ingredients help Sugar Confectionery Market to Grow

|

|

Monday, 17 April, 2017, 08 : 00 AM [IST]

|

|

Akhila Prasannan

|

Sugar confectionery is associated with food products that contain high sugar content such as boiled sweets, mints, jellies, caramel, toffee, marshmallows, nougat, lollipops, medicated confectionery and liquorice. Sugar confectioneries can be preserved for long time and are consumed by all age groups. The main ingredient being sucrose, degree of sucrose inversion, temperature & time for boiling, residual moisture content in confectionery and addition of other ingredients such as milk are major factors that affect the quality and taste of sugar confections.

Sugar confectionery was seen as a delicacy during the middle ages and was only available to the royal and upper wealthyclass of people. During the 17th century, with increased production and easy availability, boiled sugar candies mixed with fruits and nuts was popular in Europe and America. By the mid-1800s, the US had over 380 installed manufacturing facilities. However, during the early 19th century, advancements in industrial machines transformed homemade confectionery manufacturing businesses into an industry, thereby contributing in mass production of candies and making it available in bulk. The very first sweets were boiled sweets, marshmallows and Turkish delight! With time, hard candies like peppermints and lemon drops also gained immense popularity in the American region.

Taking a closer look at the current scenario, Allied Market Research predicts that the global sugar confectionery market is projected to reach $55,594 million by 2022, growing at a CAGR of 3.2% from 2016 to 2022.

According to Eswara Prasad, team lead, chemicals &materials, Allied Market Research, expansion of local brands in India is expected to boost the sugar confectionery market in Asia-Pacific. He added that expansion in production capacities with incessant R&D activities have helped local brands in India to acquire a major share in the region.

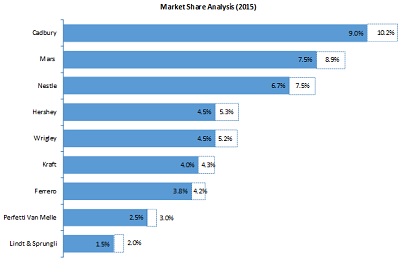

Market Share Analysis of Top Confectionery Companies

Source: Government Publications, Company Releases, and AMR Analysis

Cadbury, one of the key market players, takes 9.0%-10.2% of the market share. Likewise, Mars, Inc. is another market leader with a share around 7.5%, while Nestle S.A. has around 6.7%. Hershey’s and Wrigley accounted for 4.5% share in the confectionery market each. Ferrero is a premium manufacturer from Italy with a market penetration of around 3.8% in 2016. It focusses on premium products and specialised confectionery items and hence accounts for a lesser share.

Strategies Adopted by Key Players

Product innovation, novel packaging as well as creative positioning are the key elements undertaken by various market players to strengthen their market position and customer base.

Furthermore, major market players emphasise on promotional activities through social media marketing and advertising campaigns to increase their market share. For instance, some of them launched limited edition seasonal chocolate confections to capitalise on consumers taste for snow colour and winter-themed products. In addition, innovation in terms of textures, flavours, shapes and pack sizes has supplemented market growth. Acquisition of mid-range and small-scale oriented businesses is another major strategy adopted by key players to increase their regional reach and market revenue by maintaining customer brand loyalty.

Primarily, the global confectionery market is dominated by international brands such as Nestlé, Chupa Chups, Cadbury, Kraft Foods, and Ferrero. Premium brands continue to compete by focussing on quality, flavour and indulgence, while standard brands tend to focus on offering lower prices. Meanwhile, small-scale local brands offer the lowest price and tend to offer more basic products.

Twist in traditional flavours along-with unusual combinations of flavours have also gained popularity. Flavours such as beer-flavoured jelly beans, cake flavours like red velvet & black forest have become a favourite among confectionery makers. Strawberry cheesecake, crème brulee, peanut butter and jelly, cake batter and cookie dough also are popular picks for new products with a classic twist.

Distribution Channel

Most of the confectionery products are available in any retail stores, hypermarkets, supermarkets and convenience stores. Hypermarkets and supermarkets account for majority sales in confectionery market, while convenience stores cater to the demand from local population.

Market Insights

Hard-boiled sweets are the most popular and highest consumed confection across the globe. The US is the highest consumer of hard-boiled sweets. Sugar is used to make caramel which acts as a coating over other soft materials making a unique confection of hard and soft candy. Gums and jellies have experienced a decline in popularity.

Future Trends

Growth in retail market is expected to drive the demand for sugar confectionery in the near future. In addition, rise in disposable income and increase in population in emerging countries such as China and India is anticipated to augment the market positively. Customers prefer sugar confectioneries because of their small size and easy availability in stores. Medicated confectionery is expected to witness significant growth owing to the awareness among consumers regarding health and wellness. Also, for the population above 65 years, medicated confectionery is an innovative way to take medicines.

Challenges

Global growth in health awareness and rise in diabetes patients could hamper the sugar confectionery market. Also, overconsumption of sweets can lead to obesity and tooth decay. According to the National Health and Nutrition Examination Survey (NHANES) conducted in 2010, 74% males and 64% females were obese. Leading players in the market handle health and obesity concerns by reducing sugar content with the help of functional ingredients and fruit juices. Increase in demand for organic, premium chocolate and sugar-free products is expected to hamper the market growth during the forecast period. Use of sugar substitutes and sugar-free products such as steviol glucoside approved by European Commission for use in confectioneries is a major restraint for the sugar confectionery market.

(The author is research analyst, Allied Analytics, LLP. She can be contacted at akhila.prasannan@alliedanalytics.com)

|

|

|

|

|

|

|

|

|

|