The approximately $200 million market for yoghurt powder will witness strong yearly growth of eight per cent in 2019. This was among the findings of a recent research study of Future Market Insights (FMI), which stated that the significant demand for yoghurt powder will be generated by foodservice operators and food processors, in the near future.

While nearly three-fourth of the total consumption of yoghurt powder is accounted for by the industrial end user base, the rate of yoghurt powder consumption has been recently witnessing rapid increase within the HoReCa (hotel, restaurant and catering) sector.

Over 75 per cent of the end user base still prefers regular or non-flavoured yoghurt powder, whereas with the increasing introduction of innovative products in the powdered yoghurt category, the popularity of flavored yoghurt powder is highly likely to elevate in coming years. According to the report, vanilla and berries are more likely to emerge popular among consumers of yoghurt powder.

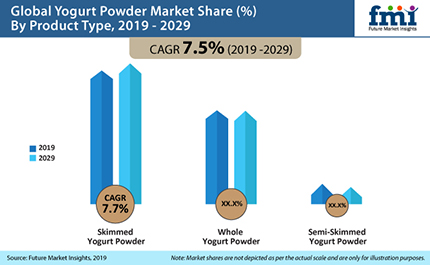

Over three-fifth of the yoghurt powder consumed globally is skimmed type, followed by whole yoghurt powder.

The report attributed the higher popularity of skimmed yoghurt powder to extensive usage in meat products, dry mixes, processed cheese, ice cream and other frozen dairy-based desserts, infant formula and confectionery.

Yogurt powder becoming natural & organic ingredient for cosmetic & personal care brands

Although over 85 per cent of the yoghurt powder is consumed for application in food and beverage products, more prominently in bakery and dry mixes, FMI’s analysis pointed to the rapidly-increasing application of yoghurt powder in the cosmetic and personal care industries.

The beauty and personal care circle is accelerating the industry’s shift to natural and organic ingredients, which has resulted in the widespread availability of a massive natural/organic product line-ups in the cosmetic and personal care industry.

Moreover, the trend has been receiving strong support with emergence of the clean label trend, catering to evolving consumer demands.

According to a recent survey conducted for the period of past 12 months, nearly 50 per cent of the UK’s beauty products’ consumer base looked for products manufactured using natural ingredients.

As yoghurt has a proven set of benefits on skin health, it has been in use in the manufacturing of specialised personal care and cosmetic products.

However, the convenience of incorporating powdered yoghurt into a range of skin care or other cosmetic products positions yoghurt powder as a more preferred ingredient among cosmetic and personal care brands.

Competition insights: Yoghurt powder market

Following North American and European food processing sectors, the food processing sector based in emerging Asian and Middle-Eastern regions is also speeding up in terms of adoption of innovative ingredients such as yoghurt powder.

Popular products such as Greek yoghurt further attract a wider consumer base, pushing innovations in the yoghurt powder landscape.

Several leading players in yoghurt powder market are focused on augmenting investments in R&D facilities – to exclusively target product innovations and novel strategies for market entry.

Many manufacturers are also developing interest in yoghurt mixes, creating a new trend wave in the competition landscape of the yoghurt powder market.

FMI’s research also finds that several yoghurt powder manufacturers are leveraging billowing sales of high-protein, low- or no-fat products.

A majority of companies operating in the yoghurt powder market landscape offer low- or no-fat products that have been made from skimmed milk.

Recently, Epi Ingredients and Glanbia Nutritionals have come up with yogurt powder variants that have protein content as high as 60 per cent with the significantly less fat content. These products have been receiving a strong consumer base within the foodservice and food processing sectors.

Key applications of high-protein yoghurt powder lie in nutritional bars, cereals, dry mixes, and energy drinks. Sports drinks and nutrition/protein bars have been cited as relatively more profitable categories for the manufacturers of yoghurt powder.